“That’s just 4% difference right? Our GST is already moving from 7% to 9%.”

I got this remark from a customer recently at the first consultation session. Indeed, it seems like not much as the returns on a $1000 is just $20 vs $60 over a year. But such small percentage over period of time can produce a significant compounding effect.

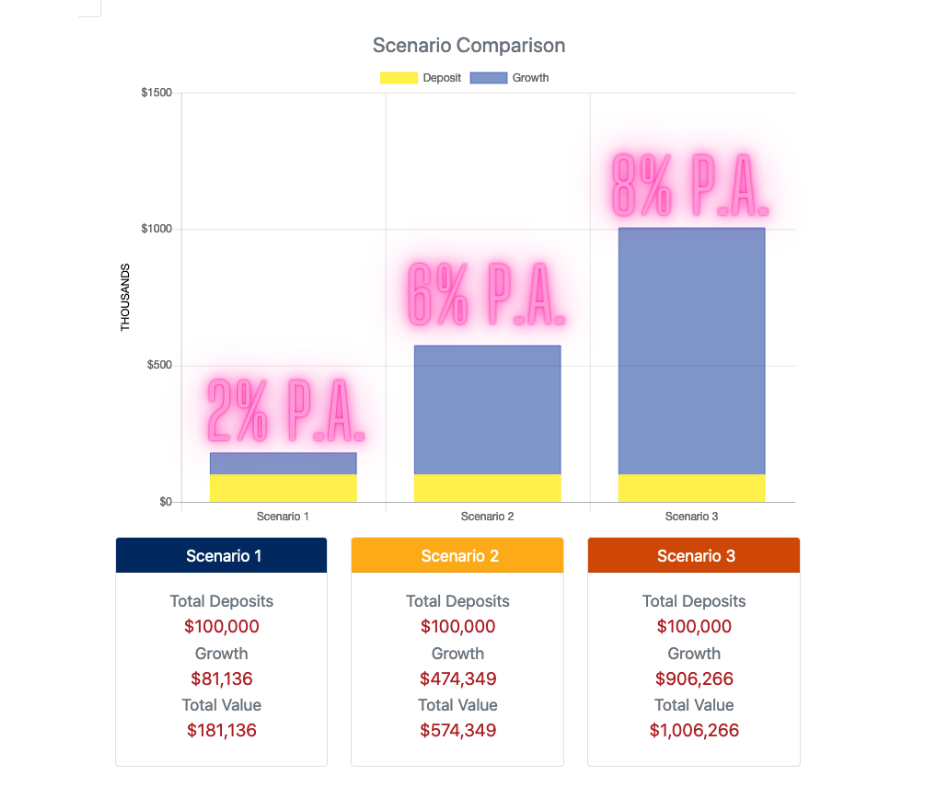

For example, over a period of 10 years, annual return of 2% vs 6% annual will mean your initial investment grows by 1.21x vs 1.79x. And over 30 years, the multiplication effects are 1.81x vs 5.74x. That is to say, if you decides to have your $100,000 kept in a 2% p.a. returns like fixed deposit or government bonds over 30 years, you will be able to see $181,136 as compared to a 6% p.a. returns from a quality and well managed investment portfolio which will grow your $100k to over $574k!

Take a look at the table below. It shows how many times your money will compound interest over (interest + principle) over a time period based on the different annual returns.

| 5yrs | 10yrs | 20yrs | 30yrs | |

| 1% | 1.05x | 1.10x | 1.22x | 1.34x |

| 2% | 1.10x | 1.21x | 1.48x | 1.81x |

| 4% | 1.21x | 1.48x | 2.19x | 3.24x |

| 6% | 1.33x | 1.79x | 3.20x | 5.74x |

| 8% | 1.46x | 2.15x | 4.66x | 10.06x |

My point here is this. An extra few percentage points in returns over a good period of time can get you a much better returns on your money and it is definite well worth your time to check out the options available. A 2% p.a. return is not even able to keep pace with the inflation of most countries, which simply means, as food, groceries, car, houses, clothings gets more expensive, your same dollar will only be worth lesser over time.

Do not shortchange yourself and miss the opportunity to know what’s better for yourself, what’s better for your family. Whether you are in your 20s, 30s, 40s or 50s, it’s never to late to get started if you haven’t. Starting late will just be more difficult. Start early, start small. Walk the journey steadily, consistently and stay invested. I’m sure you will be able to finish big, retire comfortably by choice and enjoy your later part of your life much better.